Net Debt Bridge . Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. It is used widely in equity valuation and credit. Web what is a net debt bridge? Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Net debt is the difference between a company’s total debt and its total cash (and cash.

from www.hadleycapital.com

Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. It is used widely in equity valuation and credit. Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Net debt is the difference between a company’s total debt and its total cash (and cash. Web what is a net debt bridge? Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation.

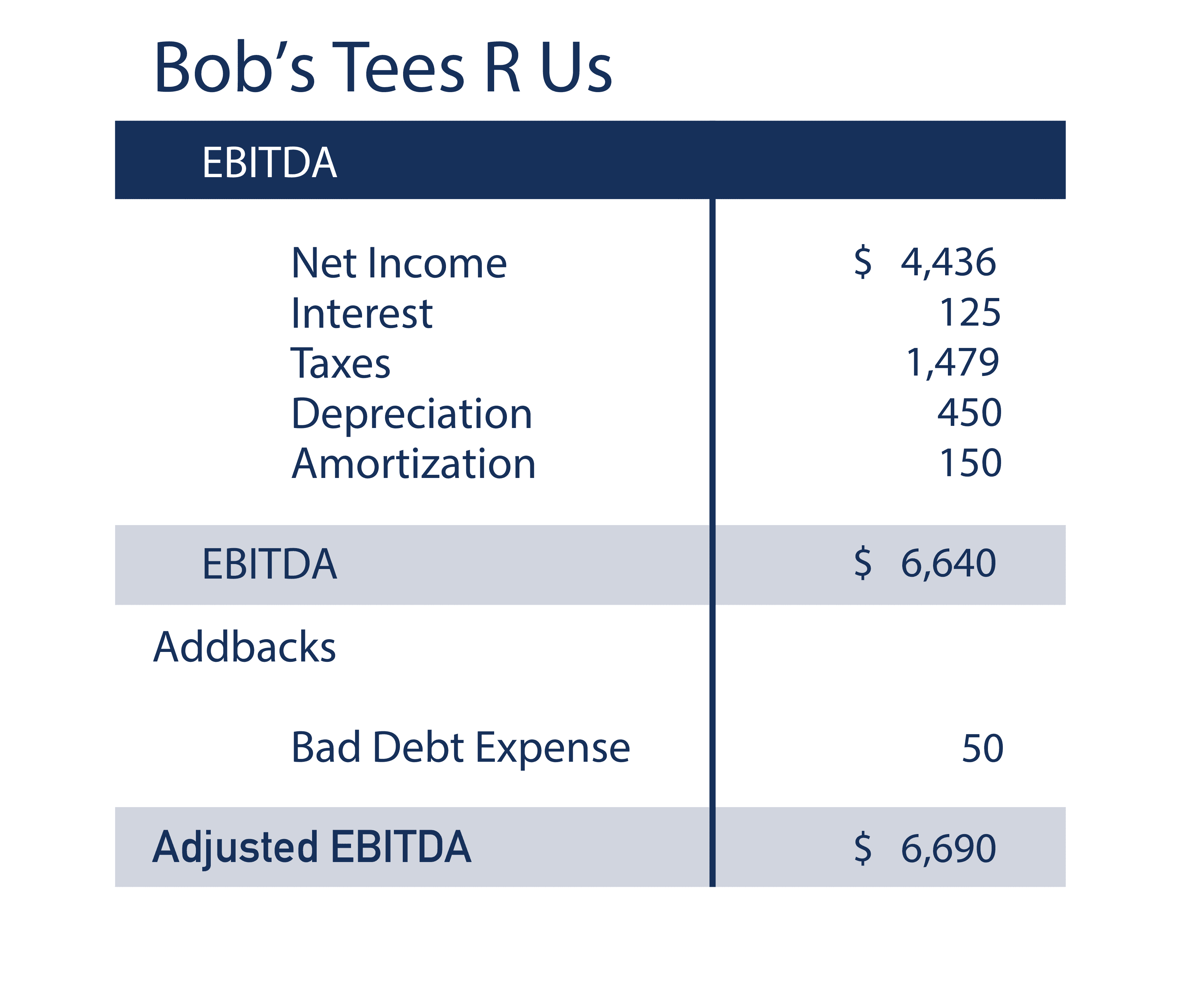

Full EBITDA Guide What is It & How Investors Use It (Formula)

Net Debt Bridge Web what is a net debt bridge? It is used widely in equity valuation and credit. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Net debt is the difference between a company’s total debt and its total cash (and cash. Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Web what is a net debt bridge? Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis.

From aswathdamodaran.blogspot.com

Musings on Markets June 2013 Net Debt Bridge Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Net debt is the difference between a company’s total debt and its total cash (and cash. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web. Net Debt Bridge.

From seekingalpha.com

Siemens Healthineers AG 2020 Q1 Results Earnings Call Presentation Net Debt Bridge Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and. Net Debt Bridge.

From templates.rjuuc.edu.np

Ebitda Bridge Excel Template Net Debt Bridge Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. It is used widely in equity valuation and credit. Enterprise. Net Debt Bridge.

From blog.socotracapital.com

A Breakdown of Why Bridge Loan Debt on Riskier Assets Is Pricier Net Debt Bridge Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Web what is a net debt bridge? It is used widely in equity valuation and credit. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Net. Net Debt Bridge.

From www.slidebook.io

AstraZeneca Results Presentation Deck Slidebook.io Net Debt Bridge Web what is a net debt bridge? Net debt is the difference between a company’s total debt and its total cash (and cash. It is used widely in equity valuation and credit. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Enterprise value. Net Debt Bridge.

From businessbanking.fsdhgroup.com

Debt & Bridge Financing FSDH Business Banking Net Debt Bridge Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Net debt is the difference between a company’s total debt and its total. Net Debt Bridge.

From www.sec.gov

6 Net Debt Bridge Sequential Quarter Sequential Net Debt Bridge, m Net Debt Bridge Net debt is the difference between a company’s total debt and its total cash (and cash. Web what is a net debt bridge? Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Web the ev to equity bridge explains the relationship between the enterprise value. Net Debt Bridge.

From seekingalpha.com

AT&T Stock Little New Except 17 Cheaper (Rating Upgrade) (NYSET Net Debt Bridge Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web this webpage addresses what items should be included in free cash flow and what should be. Net Debt Bridge.

From www.loy-cf.de

Unternehmensbewertung » Methoden, Berechnung, Verhandlung Net Debt Bridge It is used widely in equity valuation and credit. Net debt is the difference between a company’s total debt and its total cash (and cash. Web what is a net debt bridge? Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Web the ev to. Net Debt Bridge.

From www.divestopia.com

Adjusted EBITDA and EV to equity value bridge Divestopia Net Debt Bridge Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. Enterprise value represents the market value of net operational assets. Net Debt Bridge.

From www.youtube.com

Monthly Waterfall Analysis with Debt Default YouTube Net Debt Bridge Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Net debt is the difference between a company’s total debt and its total cash (and cash. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web this webpage addresses. Net Debt Bridge.

From www.youtube.com

Net Debt Formula (Example) How to Calculate Net Debt? YouTube Net Debt Bridge Net debt is the difference between a company’s total debt and its total cash (and cash. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Web what is a net debt bridge? Web this webpage addresses what items should be included in free. Net Debt Bridge.

From www.hadleycapital.com

Full EBITDA Guide What is It & How Investors Use It (Formula) Net Debt Bridge Web this webpage addresses what items should be included in free cash flow and what should be included in the enterprise to equity value. It is used widely in equity valuation and credit. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Enterprise value represents the market value of net operational assets. Net Debt Bridge.

From www.sec.gov

Page 91 Net Debt Bridge Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Net debt is the difference between a company’s total debt and its total cash (and cash. Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web what is a. Net Debt Bridge.

From www.disruptequity.com

Videos Disrupt Equity Net Debt Bridge Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Net debt is the difference between a company’s total debt and its total cash (and cash. Web what is a net debt bridge? Web this webpage addresses what items should be included in free cash flow and what should be included in the. Net Debt Bridge.

From www.coursehero.com

[Solved] A owes B two sums of money 1000 plus interest at 7 Net Debt Bridge Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and. Net Debt Bridge.

From www.linkedin.com

Calculate a Value Creation “Bridge” Online Net Debt Bridge Enterprise value represents the market value of net operational assets of a business and can be calculated using a discounted cash flow analysis. Web net debt is a useful liquidity metric for understanding the level of indebtedness of a company. Web this webpage addresses what items should be included in free cash flow and what should be included in the. Net Debt Bridge.

From www.sec.gov

Slide 20 Net Debt Bridge Web what is a net debt bridge? Net debt is the difference between a company’s total debt and its total cash (and cash. Web the ev to equity bridge explains the relationship between the enterprise value and equity value of a company and is used in trading comparables valuation. Enterprise value represents the market value of net operational assets of. Net Debt Bridge.